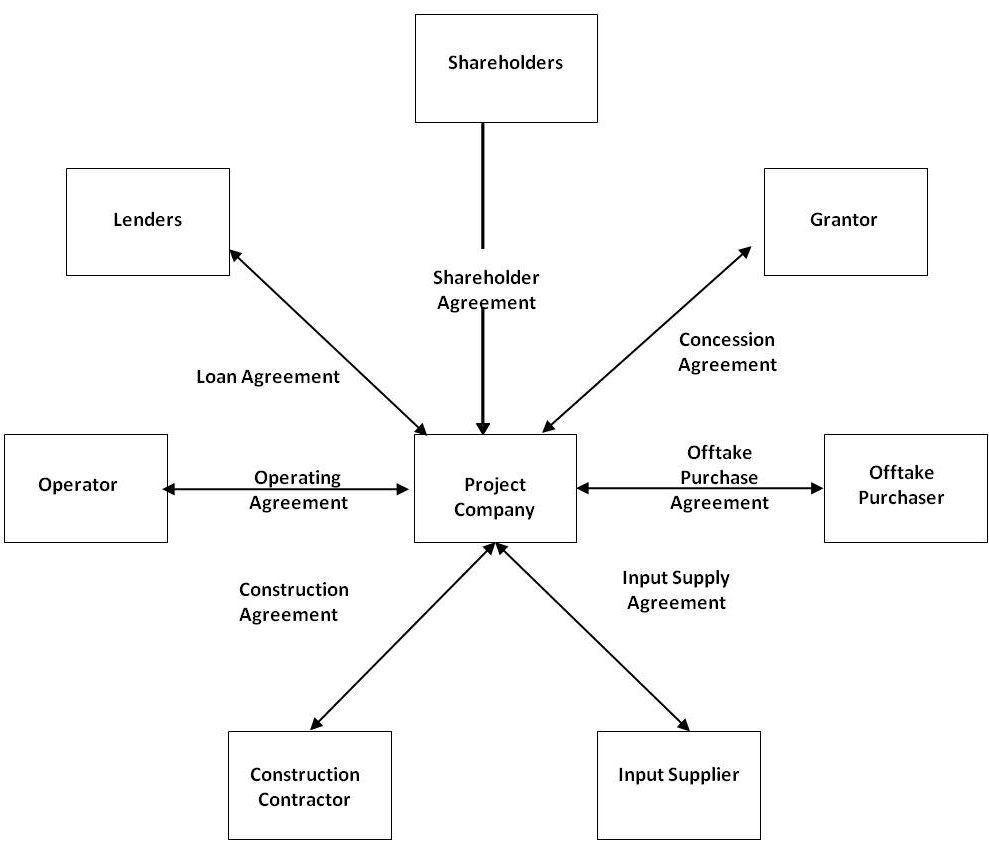

Project Finance Structure Diagram

The typical project financing structure which has been simplified for these purposes for a build, operate, and transfer (BOT) project is shown. The key elements of the structure are:

- Special Purpose Entity (SPE) project company with no previous business or record;

- Sole activity of a project company is to carry out the project – it then subcontracts most aspects through construction contract and operations contract;

- For new build projects, there is no revenue stream during the construction phase and so, debt service will only be possible once the project is online during the operations phase, thus, there are significant risks during the construction phase;

- Sole revenue stream likely to be under an off-take or power purchase agreement;

- Project finance loans are non-recourse as to the borrowers, including the sponsors of the project and shareholders of the project company. There are extensive project financing documents that require no personal liability under the project loans. Thus, the project sponsor and project shareholders are liable only up to the extent of their shareholdings;

- Project Finance Structure means the project remains off-balance sheet for the sponsors and for the host government.